Loading...

Preparing your content

Banking

AI Model-Driven Loan Market Extension -- Turning Initially Ineligible Loan Applications into "Eligible with Mitigants"

A leading product vendor providing end-to-end loan management solutions for several top banks in India.

The client supports high-volume lending journeys across retail and MSME segments. While their existing rule-based decision engine was reliable for standard applications, it failed to capture the potential of borderline or unconventional borrower profiles. This resulted in missed opportunities, reduced approval rates, and leakage of creditworthy customers to competing lenders.

The client's loan decisioning framework relied entirely on fixed eligibility rules, leaving no room for contextual interpretation or mitigant-based approvals. Key challenges included:

These constraints limited portfolio growth, reduced approval efficiency, and created poor customer experiences with dead-end rejection journeys.

To expand the client's lending universe and reduce unnecessary rejections, we implemented an AI model that dynamically identifies mitigants and alternate eligibility paths to convert an initial "reject" into an "eligible with mitigants" decision.

This intelligent system evaluates borrower data, behavioural information, and portfolio patterns to show how a customer can still qualify—without relaxing risk thresholds.

The AI evaluates multiple data combinations to find alternate ways the applicant could qualify (e.g., co-applicants, collateral, income surrogates).

Identifies missing but relevant information such as:

Suggests specific mitigants such as:

Calculates how much the borrower's risk score improves when suggested mitigants are applied, ensuring credit discipline is never compromised.

Instead of ending the journey at "Rejected," the system provides an actionable path: "Here's what you need to qualify."

Importantly, AI does not relax rules — it discovers additional data and mitigants that legitimately move the borrower into eligibility.

The AI-driven market extension framework delivered significant business value:

Learn how leading lenders are expanding their markets while maintaining risk discipline through intelligent mitigant identification.

Connect with us to explore how AI can unlock your lending potential.

How a leading product vendor achieved 6-12% incremental approvals and reduced rule definition cycles from 3-4 weeks to 1 week with AI-powered lending rules optimization.

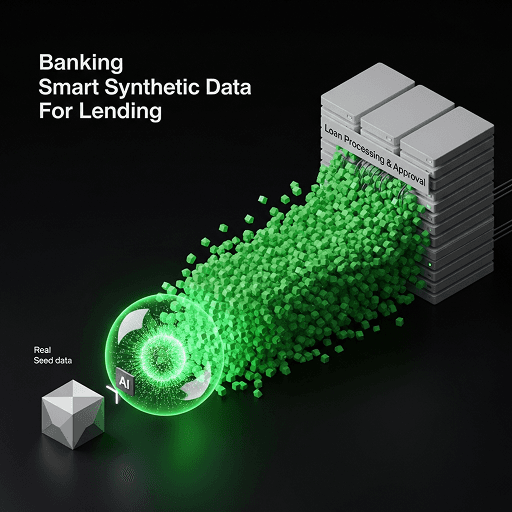

How a leading product vendor increased test coverage by 2-4× and reduced test data preparation time by 60-80% through AI-powered synthetic data generation for loan processing systems.

Ready to Transform Your Business?

Join industry leaders achieving measurable outcomes with enterprise AI that delivers real value.