Loading...

Preparing your content

Banking

Transforming Loan Product Design with AI-Driven Rule Recommendations

A leading product vendor providing end-to-end loan management solutions for several top banks in India.

The client supports large-scale loan origination and servicing operations across Home, Personal, and MSME segments. As competition intensified and borrower profiles became more diverse, their static rule-based lending framework struggled to keep pace with evolving credit patterns, alternate data signals, and risk behaviours.

The client's lending teams relied heavily on static, manually created eligibility rules that did not capture the full complexity of borrower behaviour. Key challenges included:

These limitations reduced approval percentages, slowed loan product innovation, and restricted the ability to respond quickly to market demands.

To modernize loan policy design and make rule creation data-driven, we deployed an AI-powered rules recommendation engine that learns from the client's historical lending performance and continuously suggests optimized eligibility and risk rules across loan products.

This comprehensive solution included:

AI models analyzed past approval, decline, delinquency, and repayment trends across multiple customer cohorts.

The engine identified the strongest predictive factors—bureau trends, income surrogates, behavioural signals, thresholds, and cut-offs driving risk outcomes.

Optimized rule sets were generated for Home, Personal, and MSME loan portfolios based on product-specific risk-return dynamics.

The system examined income proxies, credit utilization, enquiry patterns, vintage, and repayment behaviour to uncover new eligibility pathways.

Before deployment, each recommended rule was tested through simulations to estimate its effect on:

A reusable library of data-backed rules was delivered to accelerate new product launches, ensure consistency, and reduce dependency on manual expertise.

This AI-enhanced framework helped the client transition from static policy definition to dynamic, data-driven rule design, enabling more informed lending decisions.

With the AI-driven rule recommendation platform in place, the client observed significant improvements:

Discover how AI-driven rule recommendations can unlock new approval segments, strengthen credit quality, and accelerate product innovation.

Connect with us to explore how AI can elevate your LOS strategy.

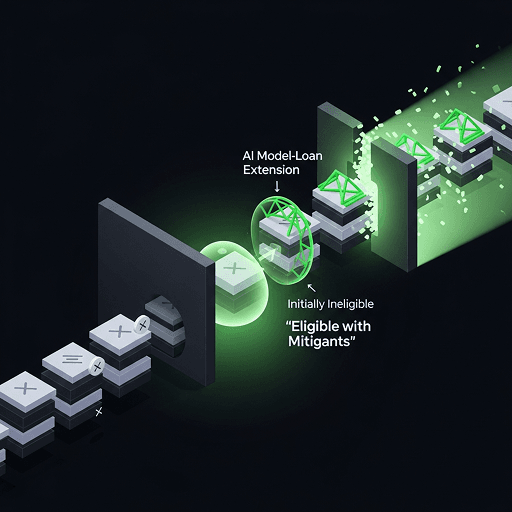

How a leading product vendor recovered near-miss borrowers and increased portfolio growth without raising risk appetite through AI-powered mitigant identification and alternate eligibility paths.

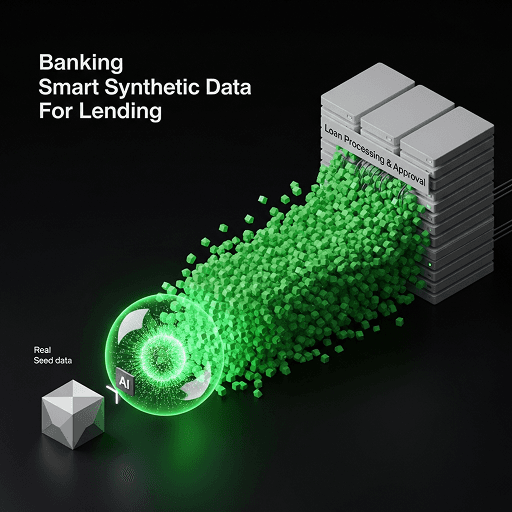

How a leading product vendor increased test coverage by 2-4× and reduced test data preparation time by 60-80% through AI-powered synthetic data generation for loan processing systems.

Ready to Transform Your Business?

Join industry leaders achieving measurable outcomes with enterprise AI that delivers real value.